The allure of digital gold, particularly Bitcoin, Ethereum, and even meme-coins like Dogecoin, has captivated investors and tech enthusiasts alike. But navigating the world of cryptocurrency mining can feel like traversing a complex labyrinth. Forget the romantic image of striking it rich with a pickaxe; today’s gold rush demands sophisticated hardware, technical know-how, and strategic investment. This guide serves as your compass, charting a course through the often-murky waters of mining machine investments.

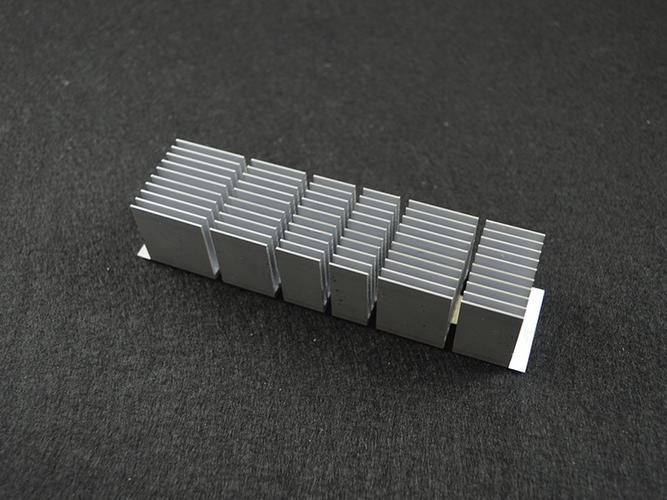

The fundamental principle of cryptocurrency mining revolves around verifying and adding new transaction blocks to a blockchain. This process requires significant computational power, provided by specialized hardware known as mining machines, or more technically, ASICs (Application-Specific Integrated Circuits) for Bitcoin and GPUs (Graphics Processing Units) for some other cryptocurrencies like Ethereum (though its mining landscape has shifted significantly post-Merge). Miners are rewarded with newly minted coins for their efforts, incentivizing them to maintain the integrity and security of the network.

Investing in a mining machine is not a passive endeavor. It’s akin to launching a small data center. You’ll need to consider factors like hash rate (the machine’s processing power), energy consumption, cooling requirements, and the overall cost of electricity. The higher the hash rate, the more chances you have to solve a block and earn rewards, but it also translates to higher energy bills. Efficient cooling is crucial to prevent overheating and ensure the longevity of your investment.

Before jumping in, conduct thorough research on the available mining machines. Compare specifications, read reviews, and assess their potential profitability. Websites like ASIC Miner Value can provide estimates, but remember that these are just projections, and actual returns can vary depending on market conditions and network difficulty (a measure of how hard it is to solve a block). Always factor in the cost of electricity and maintenance when calculating your potential profits.

An alternative to directly purchasing and managing your own mining machine is to utilize mining hosting services. These services provide the infrastructure, including electricity, cooling, and security, for your mining machine in exchange for a fee. Hosting can be particularly attractive for individuals who lack the technical expertise or space to operate their own mining facility. It also eliminates the hassle of dealing with equipment maintenance and power outages.

Mining machine hosting providers typically offer various packages with different power capacities and pricing structures. Carefully evaluate the terms and conditions of each provider before committing. Consider factors like uptime guarantees, security measures, and customer support. It’s also wise to visit the hosting facility if possible to assess its quality and reliability. Geographical location is also a key consideration; locations with cooler climates and lower electricity costs are often more advantageous.

The choice between buying a mining machine and using a hosting service depends on your individual circumstances and risk tolerance. Owning your machine offers greater control and potentially higher profits, but it also comes with greater responsibility and upfront investment. Hosting provides convenience and reduces the burden of maintenance, but it also involves ongoing fees and reliance on a third-party provider.

The cryptocurrency market is notoriously volatile, and mining profitability can fluctuate significantly. Bitcoin’s price, Ethereum’s transition to Proof-of-Stake, and the emergence of new cryptocurrencies all have the potential to impact your returns. Regularly monitor market trends, network difficulty, and electricity costs to make informed decisions about your mining operations. Diversification, within the crypto space and beyond, remains a prudent strategy.

Furthermore, consider the regulatory environment surrounding cryptocurrency mining in your jurisdiction. Some regions have implemented restrictions or outright bans on mining activities due to environmental concerns or energy consumption. Staying informed about local laws and regulations is crucial to ensure the legality and sustainability of your mining operations.

Investing in mining machines, whether directly or through hosting services, requires a blend of technical knowledge, financial acumen, and risk management. It’s not a get-rich-quick scheme, but rather a long-term investment in the future of decentralized finance. By conducting thorough research, carefully evaluating your options, and staying abreast of market trends, you can increase your chances of success in the dynamic and evolving world of cryptocurrency mining.

Finally, remember that the environmental impact of cryptocurrency mining is a growing concern. Explore options for using renewable energy sources to power your mining operations and reduce your carbon footprint. Sustainable mining practices are not only environmentally responsible but also increasingly important for the long-term viability of the industry.

This article offers an insightful exploration into the burgeoning world of mining machine investments. With comprehensive tutorials that demystify both the mechanics and strategies of digital gold acquisition, readers are equipped to navigate risks and opportunities. The rich content is not only educational but compelling, making it a must-read for potential investors.